What's the maximum you can borrow for a mortgage

Lenders will typically use an income multiple of 4-45 times salary per person. Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Below shows how different multiple incomes can.

. Check Eligibility for No Down Payment. You have three main options for receiving your money. Assuming you make 50000 per year and have no other debts you can borrow four more times your salary.

Compare Rates Get Your Quote Online Now. The limit is higher in areas where the average housing cost exceeds this figure so borrowers in high-cost. Compare Offers Side by Side with LendingTree.

Get the Right Housing Loan for Your Needs. Ad Buying A Home Can Be Complex. The maximum you could borrow from most lenders is around.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Your maximum loan amount can be affected by the type of loan a new purchase mortgage or a refinance loan and even the stage of construction the home is under. Capital and interest or interest only.

The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. Your home value is below the maximum for the area and so is below HUDs limit. Fill in the entry fields.

Ad Americas 1 Online Lender. The first step in buying a house is determining your budget. Calculate what you can afford.

614K minus the 50K down. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. But ultimately its down to the individual lender to decide.

Most lenders cap the amount you can borrow at. Generally speaking you may have trouble finding a mortgage below about 60000 unless youre searching for a specific unconventional loan type more on that below. With a capital and interest option you pay off the loan as well as the interest on it.

Unlike other types of FHA loans the maximum. Fidelity Investments Can Help You Untangle The Process. There are two different ways you can repay your mortgage.

Whatever you dont use in your credit line. Ad More Veterans Than Ever are Buying with 0 Down. Compare Rates Get Your Quote Online Now.

Calculate what you can afford and more. How much you can borrow depends on your age the interest rate you get on your loan and the value of your home. However lets say that you currently owe 150000 on your first mortgage.

Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage. If your home is worth 300000 the maximum you could borrow would be 80 of this240000. So you may find that you are eligible for mortgages that equate to 5 times or even 6 times your income with the right provider.

How much can you borrow. Ad Buying A Home Can Be Complex. Our mortgage calculator can give you a good indication of the.

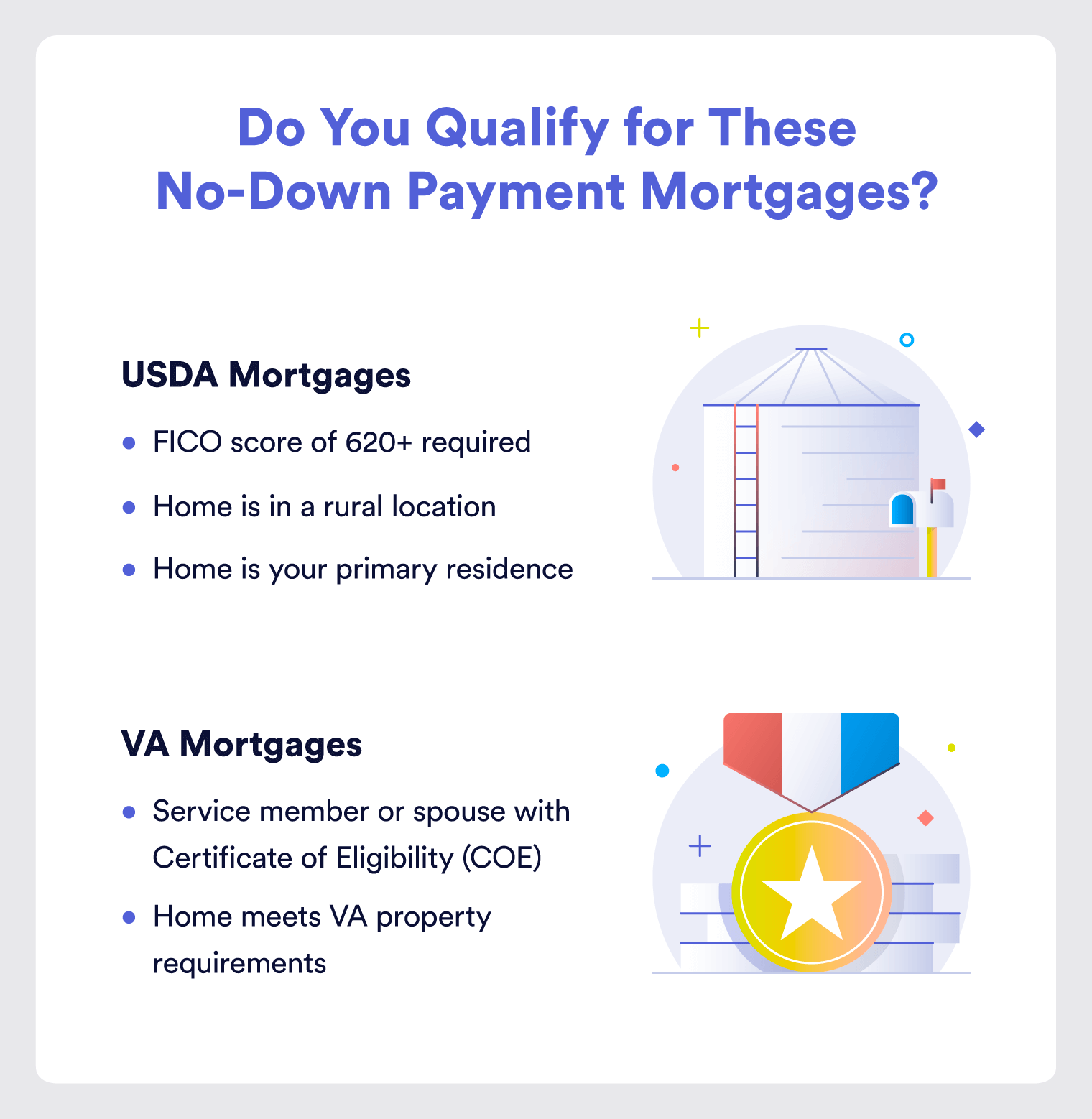

If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more. You should expect to borrow 60-75 of the value of the property. Our mortgage calculator will help you work out how much you can borrow when applying for a mortgage.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Trusted VA Home Loan Lender of 200000 Military Homebuyers. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Ad Compare Your Best Mortgage Loans View Rates. Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford. 60-year-olds are likely to borrow.

How Many More Times My Salary Can I Borrow. Myth 2 The maximum loan amount you can get from each bank doesnt vary much. Calculate how much you can borrow.

The basic loan limit for 2021 is 548250 up from 510400 in 2020. How much can you borrow. This mortgage calculator will show how much you can afford.

As part of an. Ad Americas 1 Online Lender. But in some cases that amount may be too generous.

The factor for the youngest borrower age 62 is 524 meaning that 524 percent of the. 0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. As a general rule age is the primary factor that determines your reverse mortgage maximum loan amount.

Its A Match Made In Heaven.

How Much Mortgage Can I Afford Smartasset Com

Why Be Preoccupied With What We Can T Achieve For The Time Being When We Can Become What We Can Live With Effort And Persistence In 2022 Persistence Achievement Effort

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loa Usda Loan Mortgage Loans Home Loans

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Bwsoeu 8pgnfjm

2022 Jumbo Loan Limits Ally

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

Mortgage Points A Complete Guide Rocket Mortgage

What Is 100 Mortgage Financing And How To Get It

Begonia Celorio Shojei On Instagram Ever Wonder How Much Home You Can Afford Thinking Of Increasing Your Payments With Our New App Begonia Instagram Wonder

Pin On Ontario Mortgage Financing

What You Need To Know About 401 K Loans Before You Take One

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

How Does An Fha Loan Work

Dont Miss Out On This Little Known Gem Known As Hud Reo Program Reo Properties Marketing Trends Foreclosures

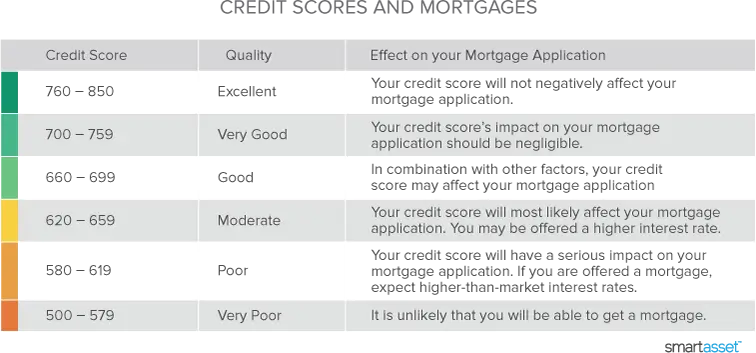

Great Information For You First Time Homebuyers Qualify For All Four Apply Here Loanfimortgage Com Understanding Mortgages Mortgage Bad Credit Mortgage

How To Get A Mortgage Without Financially Freaking Out Mortgage Tips Freak Out Mortgage

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice