Salary calculator with overtime and taxes

2022 Philippines BIR TRAIN Withholding Tax calculator for employees. This is how you work it out.

Calculating An Employee S Gross Pay Is Already Complex With The Numerous Factors To Consider Including The Number Of Hours Payroll Software Payroll Income Tax

If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10.

. If you know your tax code you can enter it or else leave it blank. This is your take home pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

Step 5 Additional withholdings. Dont forget that this is the minimum figure as laid. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Net pay would deduct taxes Social Security Medicare local state and federal taxes health insurance. Regular pay of 15 8 hours 120. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

It does calculate net pay. All Services Backed by Tax Guarantee. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total.

To try it out enter the. This calculator determines the gross earnings for a week. Figure out how much each employee earned.

First enter your current payroll information and deductions. The default value for overtime rate of the overtime pay calculator is 15. 1000154 1500 4 6000.

Generate your paystubs online in a few steps and have them emailed to you right away. 1200 40 hours 30 regular rate of pay 30 x 15 45 overtime. Your taxes are worked out based on your full pay so you need to add together your ordinary income with any overtime income in order to reach your own calculation.

Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use this calculator to help you determine your paycheck for hourly wages.

Next divide this number from the annual salary. The formula to calculate tax liability. Taxable income Tax rate Tax liability.

Calculate taxes youll need to withhold and additional taxes youll owe. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Create professional looking paystubs.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. 8000 6000 14000.

Taxable income Annual gross salary - Pension Provident RAF limited to 275 of salary limited to. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did. Pay your employees by subtracting taxes and any other.

The adjusted annual salary can be calculated as. Wage for the day 120 11250 23250. Once you have worked out your tax liability you minus the.

Then enter the hours you expect to work and how. Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee.

30 8 260 - 25 56400. We use the most recent and accurate information. Overtime pay of 15 5 hours 15 OT rate 11250.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Depending on the employer and its incentive policy the overtime multiplier may be greater. Exempt means the employee does not receive overtime pay.

Building Maintenance Checklist Templates 7 Free Docs Xlsx Pdf Maintenance Checklist Checklist Template Checklist

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Pin On Business

Personal Injury Lawyer Helping You Get The Best Settlement Eliott Dear Esq Personal Injury Lawyer Injury Lawyer Personal Injury

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll

Payroll Processing Services Haryana Payroll Legal Services Payroll Taxes

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Bookkeeping Templates Payroll Template

Salary Calculator Template Google Docs Google Sheets Excel Apple Numbers Template Net Salary Calculator Salary Calculator

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

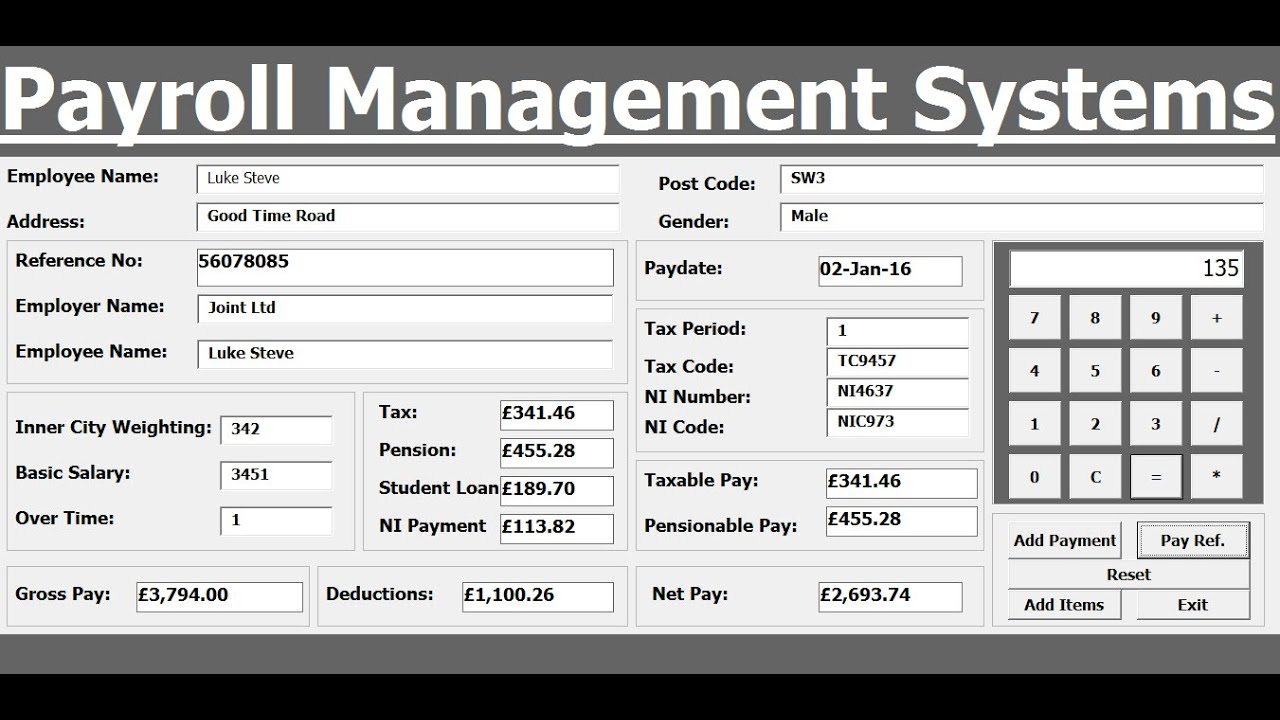

How To Create Payroll Management Systems In Excel Using Vba Youtube Payroll Management Excel

Construction Project Schedule Template Best Of Construction Schedule Template Free Easy Download Schedule Template Schedule Templates Templates

Health And Fitness Schedule Example Workout Calendar Easy Workouts Workout Schedule

9 Ready To Use Salary Slip Excel Templates Exceldatapro Excel Templates Payroll Template Salary

Award Winning Cloud Based Hr Payroll Software In Singapore Video Payroll Software Hospitality Design Hrms

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies